Shopping for a automotive is a serious and infrequently irritating buy. To enhance this expertise, Capital One launched Chat Concierge, an AI agent designed to simplify automotive shopping for. In contrast to typical chatbots, this conversational agent makes use of a number of specialised AI brokers to grasp prompts, create and validate motion plans, and execute duties based mostly on purchaser preferences. Chat Concierge was constructed to have the ability to examine autos, estimate trade-in values, and schedule take a look at drives in a single dialog. This kind of innovation marks a brand new period in digital banking the place AI brokers take motion, paving the way in which for extra agentic experiences in our lives.

Digital Banking Is Poised For A Revolutionary Transformation Over The Subsequent Decade

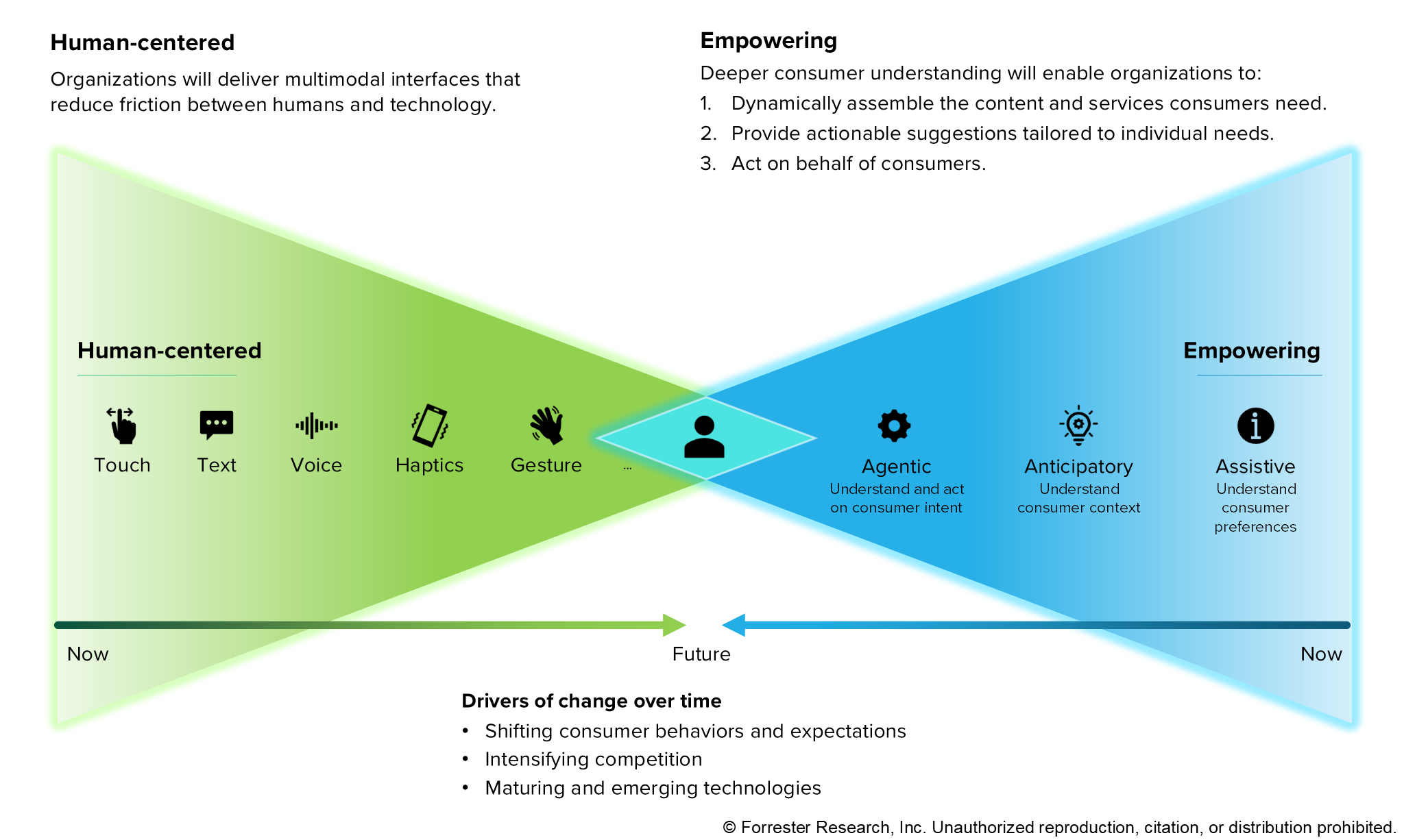

In my new report, The Future Of Digital Experiences, I discover how banks, fintechs, and massive tech corporations will leverage each maturing and rising applied sciences to redefine digital banking experiences, in the end reshaping the monetary panorama. So what’s on the horizon?

AI-powered interfaces: crafting human-centered digital banking experiences

Conversational banking has emerged in recent times, and developments in AI are set to additional remodel shopper interactions inside monetary companies. The way forward for digital banking will probably be outlined by fashionable, intuitive, and human-centered interfaces. AI-powered digital assistants will observe, collect data, be taught, and talk with customers. It will permit organizations to achieve deeper insights into shopper intent and feelings, enabling them to generate multimodal responses that incorporate applicable tone, emotion, and visible components.

AI and IoT: unlocking shopper insights and reworking information into actionable intelligence

Sooner or later, sensors and IoT analytics mixed with AI will assist corporations perceive customers’ context and intent. Open finance will allow safe information sharing throughout ecosystems, supporting embedded finance. Moreover, superior AI and analytics will flip uncooked information into actionable insights, whereas AI and ML will streamline information processing. Giant language fashions and generative AI will improve information evaluation, creating huge datasets and new content material. In the meantime, sensory AI, artificial information, and explainable AI will enhance situational understanding, generate insights the place information is proscribed, and make AI techniques extra clear and reliable.

Edge computing and AI: accelerating real-time insights and autonomous decision-making

Edge computing and AI, powered by quicker networks (5G/6G) and superior {hardware}, will carry information processing nearer to its supply, decreasing latency and bandwidth use. It will allow quicker insights, real-time analytics, and smarter decision-making. Actual-time transactions and information processing will improve responsiveness and effectivity. AI decisioning applied sciences will scale near-real-time engagement, whereas IoT will embed finance into objects, autos, and houses, creating automated, IoT-enabled eventualities.

AI brokers: automating choices and paving the way in which for autonomous finance

AI and superior analytics will automate choices, processes, and experiences. Professional AI brokers will combine evaluation and execution, automating advanced duties. Though nonetheless in its early phases, agentic AI will pave the way in which for extra superior AI purposes in automation and personalised companies. Finally, this may result in the event of private AI brokers and autonomous finance.

Banks And Platforms Will Empower Customers With Future Digital Experiences

Over the following decade, we imagine that customers will shift from inflexible, predetermined paths to cocurated, conversational journeys. They’ll take a extra energetic function in deciding the place, what, and the way they devour content material, data, and recommendation. Banks and platforms will scale back cognitive load by delivering the proper content material or companies in the mean time of want, dynamically assembling content material and companies based mostly on information and context, offering actionable recommendations, and performing on behalf of customers with their permission.

Digital Banking Experiences Will Evolve Via Three Phases

As customers undertake new digital experiences and applied sciences mature, Forrester expects digital banking experiences to evolve by three interrelated and mutually reinforcing phases:

- Assistive experiences. At the moment, customers work together with banks by chatbots and digital assistants, asking questions, making funds, and disputing transactions. Banks use information and real-time fashions to have interaction customers with related experiences, delivering tailor-made insights, alerts, and recommendations.

- Anticipatory experiences. On this part, customers will have interaction in significant interactions by multimodal interfaces, sharing complete information with banks and platforms. Conversational AI assistants will evolve into trusted digital monetary advisors, utilizing information and predictive instruments to generate personalised insights and assist scale back monetary stress. Banks and platforms will constantly optimize experiences by providing diagnostic instruments, teaching, and real-time options.

- Agentic experiences. On this part, banks and platforms will leverage agentic AI techniques for real-time personalization and automation. Customers will use private AI brokers educated with their information to refine outputs and handle funds. Main platforms similar to Apple and Google will use AI to create dynamic experiences, with private AI brokers autonomously in search of data, studying, and performing on customers’ behalf. As AI applied sciences advance, digital monetary assistants will present extra complete recommendation throughout varied monetary merchandise, reworking the panorama of autonomous finance.

Belief Will Be A Key Issue In Shaping This Future

Belief will probably be a key consider figuring out how a lot private information customers are prepared to share, the diploma of autonomy they permit AI brokers, and the breadth of companies they make the most of. Empowered customers will demand transparency and management over their information, sharing it just for personalised experiences that provide actual worth. They’ll tailor their interactions with AI, balancing comfort and management based mostly on perceived dangers.

In the event you’re a Forrester consumer, learn the total report, The Future Of Digital Experiences, to grasp how digital banking experiences will evolve and the way to put together for that future. And keep tuned for upcoming analysis on conversational and agentic banking as we proceed to discover the way forward for digital experiences. Go to my Forrester bio web page and click on “Comply with” to obtain notifications. You may as well comply with me on LinkedIn right here. Forrester purchasers also can schedule an inquiry or steering session with me to delve deeper into this matter.